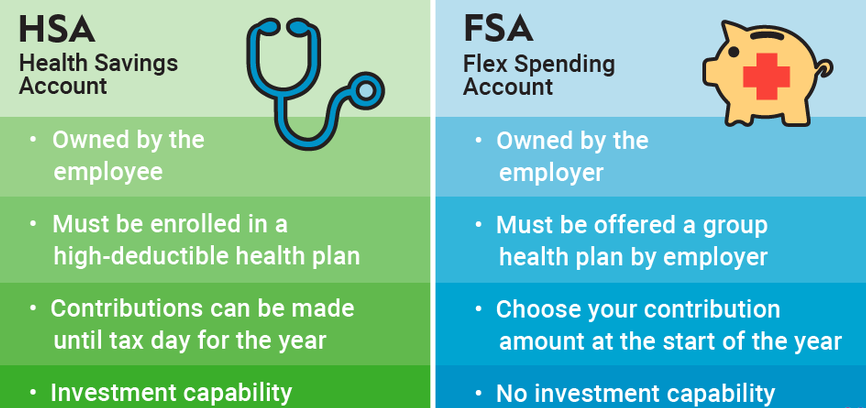

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are both financial tools that help you save money on healthcare costs by allowing you to set aside pre-tax dollars for medical expenses. Although they serve similar purposes, they have distinct differences in terms of eligibility, contribution limits, and how they function. In this article, we’ll explore how both HSAs and FSAs work, the benefits they provide, and how you can make the most of these accounts to maximize your healthcare savings.

What is a Health Savings Account (HSA)?

An HSA is a tax-advantaged savings account designed to help individuals save for medical expenses while they are enrolled in a high-deductible health plan (HDHP). The funds in an HSA can be used to pay for qualified medical expenses such as doctor visits, prescription drugs, dental care, and vision services.

Key Features of an HSA:

- Eligibility: To open an HSA, you must be enrolled in an HDHP. The IRS defines an HDHP as a health plan with a deductible of at least $1,400 for individuals and $2,800 for families (for the 2025 tax year).

- Pre-tax Contributions: Contributions to an HSA are tax-deductible, meaning the money you contribute to your HSA reduces your taxable income, potentially lowering your overall tax bill. In addition, any earnings from interest or investments in the account are tax-free.

- Contribution Limits: For 2025, the annual contribution limit for individuals is $3,950, and for families, it is $7,900. If you’re 55 or older, you can contribute an additional $1,000 as a “catch-up” contribution.

- Rollover of Funds: One of the most attractive features of an HSA is that the funds in the account roll over year after year. Unlike FSAs, which may require you to use the funds by the end of the year or forfeit them, the money in an HSA is not subject to a “use-it-or-lose-it” rule.

- Portability: Your HSA is yours to keep, even if you change jobs or insurance plans. The account stays with you, and you can continue using it to pay for medical expenses.

What is a Flexible Spending Account (FSA)?

An FSA is another tax-advantaged account that allows you to set aside money for healthcare costs, but it is offered through your employer rather than being tied to a specific type of health plan. FSAs can be used for many of the same expenses as HSAs, such as co-pays, prescriptions, and medical procedures. However, they have some key differences in terms of eligibility, contribution limits, and usage.

Key Features of an FSA:

- Eligibility: FSAs are generally available to employees who work for an employer offering the benefit. You do not need to be enrolled in an HDHP to qualify for an FSA.

- Pre-tax Contributions: Like HSAs, FSAs allow you to contribute pre-tax dollars, which lowers your taxable income and reduces your overall tax burden.

- Contribution Limits: For 2025, the annual contribution limit for an FSA is $3,050 per employee. Employers may also contribute to the account, but the total amount (employee and employer contributions combined) cannot exceed the annual limit.

- Use-it-or-Lose-it Rule: FSAs have a significant drawback compared to HSAs: you must use the funds in your account by the end of the plan year or risk losing them. Some employers may offer a grace period or allow you to carry over a limited amount of money into the next year (up to $610 in 2025), but in most cases, unused funds are forfeited.

- Employer-Sponsored: FSAs are set up and managed through your employer, meaning that you cannot open an FSA independently. Contributions are typically deducted from your paycheck on a pre-tax basis.

Key Differences Between HSAs and FSAs

While both HSAs and FSAs help you save money on healthcare costs, they differ in several important ways:

| Feature | HSA | FSA |

|---|---|---|

| Eligibility | Must be enrolled in an HDHP | Offered through employer, no HDHP required |

| Contribution Limits | $3,950 (individual) / $7,900 (family) | $3,050 (employee) |

| Rollover | Funds roll over year to year | Use-it-or-lose-it (except for some carryover options) |

| Portability | Can keep the account when changing jobs | Account is tied to your employer |

| Account Ownership | Owned by you | Owned by your employer |

| Tax Benefits | Pre-tax contributions, tax-free growth | Pre-tax contributions, but no tax-free growth |

| Catch-Up Contributions | $1,000 if over age 55 | No catch-up contributions |

How to Use Your HSA

To make the most of your Health Savings Account, follow these tips:

- Maximize Contributions: If you are eligible for an HSA, consider contributing the maximum allowed each year to take full advantage of the tax benefits. The more you contribute, the more you can reduce your taxable income. Additionally, the funds in your HSA will grow tax-free, which makes it a powerful long-term savings tool.

- Use HSA Funds for Qualified Expenses: You can use your HSA to pay for a wide range of medical expenses, including doctor visits, hospital stays, prescriptions, dental care, and vision services. Be sure to keep receipts for any purchases made with HSA funds in case the IRS requires proof that the expenses are qualified.

- Invest Your HSA Funds: Many HSA providers allow you to invest the funds in your account, much like a retirement account. If you have a significant balance, consider investing in low-cost index funds or other options to grow your savings over time.

- Save for Retirement: After you reach age 65, you can use your HSA funds for any purpose, including non-medical expenses, without paying a penalty (though regular income taxes will apply). This makes an HSA an excellent supplemental retirement account.

- Take Advantage of Catch-Up Contributions: If you’re 55 or older, you can make an additional $1,000 catch-up contribution. This is especially useful if you’re looking to build your HSA balance before retirement.

How to Use Your FSA

To make the most of your Flexible Spending Account, consider the following tips:

- Plan for Your Contributions: Since FSA funds are typically subject to the use-it-or-lose-it rule, it’s important to estimate your healthcare costs for the year accurately. Contribute enough to cover predictable medical expenses, such as co-pays for doctor visits, prescription drugs, and other out-of-pocket costs.

- Use Your FSA for Eligible Expenses: FSAs can be used for a wide range of healthcare costs, including medical, dental, and vision care. You can also use FSA funds for over-the-counter medications and certain wellness products, depending on your plan’s rules. Make sure to check your plan’s list of eligible expenses to avoid any misunderstandings.

- Track Your FSA Balance: Many employers provide a website or app to track your FSA balance, making it easier to monitor how much you’ve spent and how much is left. Keep track of your spending to ensure you use the funds before the end of the plan year.

- Submit Claims on Time: Be sure to submit any eligible expenses for reimbursement before the deadline. If you don’t use all the funds by the end of the year, you may lose them (unless your employer offers a carryover or grace period).

- Employer Contributions: Some employers offer to contribute to your FSA, so be sure to check if your employer provides this benefit. Employer contributions can help offset your healthcare costs and increase the amount available for medical expenses.

Maximizing the Benefits of Both Accounts

If you are eligible for both an HSA and an FSA (for example, if your spouse has an FSA while you have an HSA), you can use these accounts together to save on medical costs. For example:

- You can use your HSA for large medical expenses and long-term savings, while using the FSA for smaller, short-term expenses like prescriptions, copays, and dental visits.

- Keep track of your FSA and HSA balances to avoid over-contributing or accidentally paying for the same expenses with both accounts.

Conclusion

Both Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) provide valuable opportunities to save money on healthcare expenses. By contributing pre-tax dollars to these accounts, you can reduce your taxable income while paying for medical costs. However, HSAs offer greater flexibility, portability, and the potential for long-term savings growth, while FSAs are best suited for predictable medical expenses within a single plan year. Understanding the strengths and limitations of each account is key to making the most of your healthcare savings and improving your overall financial health.