Buying a home is one of the most significant financial investments you’ll make in your lifetime. Whether it’s your first home or a second property, securing a mortgage is usually necessary to help finance the purchase. However, as important as the loan is in helping you achieve homeownership, so is protecting that investment with home insurance. Many people may question whether home insurance is necessary if they already have a mortgage, but it is an essential aspect of safeguarding your home, your financial security, and your future. This article will explore why home insurance is crucial, even if you have a mortgage, and how it can protect you in ways that extend beyond the lender’s requirements.

What is Home Insurance?

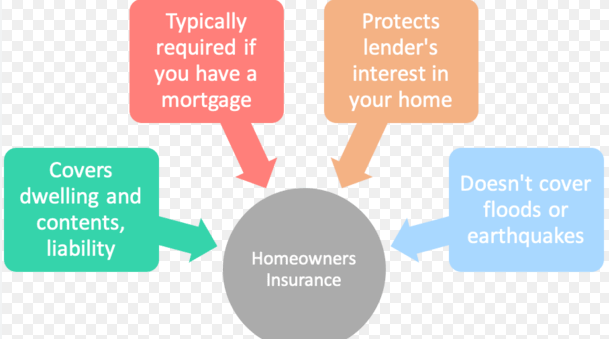

Home insurance, also known as homeowner’s insurance, is a policy that protects you financially if your home and belongings are damaged or destroyed. It typically covers losses caused by events like fire, storm damage, vandalism, theft, and even liability in case someone is injured on your property. Home insurance also typically covers the cost of temporary living expenses if your home becomes uninhabitable due to damage.

Mortgage lenders require home insurance as part of the loan agreement to protect their investment, but it also provides vital protection for the homeowner. If something happens to your property, home insurance ensures you can repair, rebuild, or replace the damaged structure and possessions. Without insurance, you could face significant out-of-pocket costs that might otherwise be covered.

Lender Requirements for Home Insurance

When you take out a mortgage to purchase a home, the lender is financially invested in the property as collateral for the loan. They want to ensure that the home remains in good condition because it is their security if you default on the loan. For this reason, most mortgage lenders will require you to carry home insurance as a condition of the loan.

Lenders typically require that you have home insurance coverage equal to or greater than the loan amount or the cost to rebuild the home. The lender may also require you to list them as an “additional insured” party on the policy. This means that if the insurance company issues a payment for damages, the lender will receive a portion of the payout to ensure the loan is covered.

While lenders often require insurance to protect their financial interests, home insurance also provides critical protection for you as the homeowner, far beyond the lender’s requirements.

Protecting Your Investment

The most significant reason you need home insurance when you have a mortgage is to protect your investment. Buying a home is a huge financial commitment, often requiring years or even decades of payments. Without insurance, you risk losing your investment if something catastrophic happens.

For example, if a fire or storm damages your home or destroys it completely, you could be left with a significant financial burden. Without insurance, you would need to pay out-of-pocket for repairs, rebuilding, or finding a new place to live. Depending on the extent of the damage, this could cost thousands or even hundreds of thousands of dollars. Home insurance provides peace of mind by covering these expenses, allowing you to rebuild and recover from disasters without draining your savings or taking on additional debt.

Coverage for Property and Belongings

In addition to protecting the structure of your home, home insurance also covers the contents inside, such as furniture, electronics, clothing, and personal belongings. If these items are damaged or destroyed by an insured event, such as theft, fire, or vandalism, your home insurance policy can help replace them.

Mortgage lenders may not care about the replacement value of your belongings, but as a homeowner, it’s essential to ensure that your possessions are covered in the event of a disaster. You may have significant investments in your home’s interior, such as appliances, furniture, and electronics. Home insurance allows you to replace these items without taking a financial hit.

Liability Protection

Another critical aspect of home insurance is liability coverage. This protects you financially if someone is injured on your property and files a lawsuit against you. For example, if a guest slips and falls while visiting your home, or if your dog bites someone, liability coverage helps cover medical expenses, legal fees, and other costs associated with the injury.

If you have a mortgage, your lender may not require liability coverage, but it is an essential form of protection for homeowners. Medical expenses and legal costs from an injury on your property can quickly add up, potentially bankrupting you without adequate insurance coverage. Liability protection in a home insurance policy ensures that you are financially protected in such situations.

Temporary Living Expenses

In the event that your home becomes uninhabitable due to a covered event, such as a fire or natural disaster, home insurance can help cover temporary living expenses. This coverage, often referred to as “loss of use” coverage, pays for things like hotel stays, meals, and other necessary expenses while your home is being repaired or rebuilt.

This is particularly important if you live in an area prone to disasters, such as hurricanes, wildfires, or floods. Even if your mortgage lender doesn’t require it, having coverage for temporary living expenses can make it easier to navigate difficult situations without adding financial stress to an already challenging time.

Peace of Mind

Having home insurance gives you peace of mind knowing that, should something go wrong, you are financially protected. For many people, their home is their largest and most valuable asset. Without home insurance, you would bear the full financial burden of replacing or repairing it. Knowing that you’re protected from unforeseen events allows you to focus on other aspects of life without worrying about what might happen in the future.

Even if you don’t think you need home insurance because your home is paid off or you have savings set aside, it’s important to consider how much it would cost to replace your home and belongings. Without insurance, even a small accident or natural disaster could have devastating consequences on your financial well-being.

Why Is Home Insurance Still Necessary After Paying Off Your Mortgage?

Once you’ve paid off your mortgage, it may seem like home insurance is no longer required. However, maintaining home insurance after paying off your mortgage is still an essential step for protecting your home and your finances. Here’s why:

- Home Value Appreciation: Over time, your home may increase in value, and it may cost more to rebuild or repair than when you first bought it. Your home insurance coverage should reflect the current value of your property to ensure adequate protection.

- Personal Assets: Even if the mortgage is paid off, you still need protection for your personal belongings. Without home insurance, you risk losing everything inside your home in case of a disaster.

- Liability Risks: Liability coverage is still important even after paying off your mortgage. Injuries or accidents that happen on your property can lead to lawsuits, and you’ll want to have liability protection to help cover these costs.

- Peace of Mind: Finally, even after paying off your mortgage, you’ll want the peace of mind that your property is protected. The financial consequences of a major disaster or accident can be overwhelming, and insurance can offer protection for both your property and your personal well-being.

Conclusion

Home insurance is not only a requirement by your mortgage lender—it’s a vital safeguard for you as a homeowner. It helps protect your investment in your home, covers the contents inside, provides liability protection, and even assists with temporary living expenses in case of a disaster. Whether you are paying off a mortgage or have already done so, having home insurance ensures that your property and personal assets are financially protected in the event of an unexpected loss or emergency.

While home insurance is often required by lenders, it is just as important for the homeowner to maintain this coverage to preserve the financial security and peace of mind they have worked hard to achieve. Without home insurance, the financial impact of an accident, disaster, or theft could be devastating. So, if you have a mortgage, make sure you’re adequately insured, and even after you’ve paid it off, consider maintaining coverage to continue protecting your home and assets for the long term.