When you’re ready to purchase a home, one of the biggest decisions you’ll face is where to get your mortgage. Should you approach a traditional bank or a credit union? Both options offer home loans, but they differ in terms of structure, customer experience, and benefits. Your choice could have a significant impact on your interest rates, fees, and overall experience during the home-buying process. In this article, we’ll compare getting a mortgage through a bank versus a credit union to help you make an informed decision.

Understanding Banks and Credit Unions

Before diving into the specifics of how they differ, let’s first explore what banks and credit unions are and how they operate.

- Banks are for-profit financial institutions that offer a wide range of services, including savings and checking accounts, credit cards, personal loans, and mortgages. Banks are typically large institutions with national or international reach and are regulated by federal and state agencies.

- Credit Unions are nonprofit, member-owned financial institutions. To join a credit union, you must meet certain membership requirements, which are typically based on your location, employer, or a specific organization. Credit unions operate on a more localized or community-based model and are also regulated by federal and state agencies. They exist to serve their members rather than to generate profit, which often allows them to offer more favorable terms and lower fees.

Now, let’s compare how each type of institution stacks up when it comes to mortgages.

Mortgage Rates and Fees: Which One Is Better?

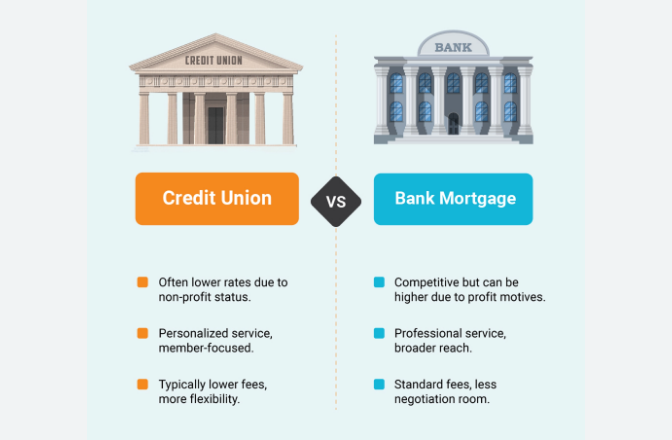

When it comes to mortgages, the interest rate is one of the most important factors, as it directly affects your monthly payment and the overall cost of the loan. Fees, such as origination fees, application fees, and closing costs, also have a significant impact on the cost of getting a mortgage. Let’s take a look at how banks and credit unions differ in these areas.

Mortgage Rates

- Banks: Banks tend to offer competitive mortgage rates, especially for well-qualified borrowers. However, because banks are large institutions with extensive operations, they must factor in higher overhead costs, which can sometimes result in slightly higher rates compared to credit unions. Banks also often offer a wide range of mortgage products, including fixed-rate mortgages, adjustable-rate mortgages (ARMs), and jumbo loans, which might give you more options to choose from.

- Credit Unions: Credit unions typically offer lower mortgage rates compared to banks. Since credit unions are nonprofit organizations, they don’t need to generate profits for shareholders. Instead, they can pass on the savings to their members in the form of lower rates and fees. This can be a significant advantage if you are eligible to join a credit union and can qualify for their loans. For many homebuyers, this lower rate can mean thousands of dollars in savings over the life of the loan.

Fees

- Banks: Banks may charge higher fees due to their larger, more complex operational structure. These fees can include origination fees, underwriting fees, processing fees, and more. In some cases, banks may also charge higher application fees, and their loan products may come with fewer customizable options in terms of fees and payment structures.

- Credit Unions: Credit unions generally have lower fees because they operate on a nonprofit model. Many credit unions offer low or no application fees, lower origination fees, and fewer hidden costs. Some may even offer discounts on closing costs for members with longstanding relationships. This lower fee structure can make a significant difference, especially for first-time homebuyers.

Customer Service: Personalized Attention vs. Efficiency

The customer experience when applying for a mortgage can vary significantly between banks and credit unions. How important this is to you will depend on your priorities—whether you value personalized service or the efficiency and convenience of a larger institution.

Banks

- Efficiency: Banks, especially larger ones, often have streamlined mortgage processes. They may offer online applications, automated pre-approvals, and the convenience of managing your mortgage account through a mobile app or online banking. This can be a big advantage for tech-savvy individuals who value convenience and speed.

- Less Personalized Attention: While many banks provide excellent customer service, their size and structure can make it difficult to get the personalized attention that some borrowers may desire. You may be passed between departments or have to deal with automated systems during the application process, which can be frustrating for those who prefer a more hands-on approach.

Credit Unions

- Personalized Service: Credit unions are often known for their personalized, member-first approach to banking. Because credit unions are smaller and have a more localized membership, you are more likely to work with a loan officer who knows you by name and is familiar with your financial situation. This can be especially valuable during the mortgage process, which can be complex and involve a lot of paperwork.

- Longer Process: The personalized service at credit unions might come at the expense of speed. Since credit unions are often smaller institutions, their mortgage process may take longer than that of a large bank. If you’re looking for a quick and efficient process, a bank might be the better choice. However, if you prioritize one-on-one service and a more hands-on approach, a credit union could be the way to go.

Loan Options and Flexibility

When it comes to the variety of mortgage products, banks generally have more options because of their size and resources. However, credit unions can still offer a good range of loan types, though they might be more limited in certain areas.

Banks

- Variety of Loan Products: Banks typically offer a broader selection of mortgage products, including various types of conventional loans, government-backed loans like FHA, VA, and USDA loans, and even jumbo loans for high-value properties. This variety can be a significant advantage if you’re looking for a specific type of loan that is not widely available.

- More Rigorous Qualification Standards: Because banks are profit-driven, they may have stricter lending standards than credit unions, especially when it comes to credit score requirements, income verification, and down payment thresholds. While this can sometimes lead to better rates for highly qualified borrowers, it may make it harder for those with less-than-perfect credit to secure a loan.

Credit Unions

- Flexibility: Credit unions tend to have more flexibility in underwriting loans. Because they are nonprofit institutions, they may be more willing to work with you on your application, particularly if you have a strong history with the credit union. For example, if you’ve been a member for many years, you may receive more personalized consideration for approval.

- Limited Loan Options: While many credit unions offer competitive rates for conventional and government-backed loans, they may not have the same variety of loan products as larger banks. If you’re seeking a less common loan type, such as a jumbo loan or a specialized loan for investment properties, a bank may be a better fit.

Access to Online Tools and Technology

For some homebuyers, the convenience of managing their mortgage online can be a deciding factor in choosing where to get a loan. While technology and online tools are becoming increasingly important, there are notable differences between banks and credit unions in this regard.

Banks

- Advanced Online Tools: Large banks often have robust online platforms that allow you to manage your mortgage application, track progress, and even make payments through a mobile app. They also often provide online calculators and other tools to help you estimate your mortgage payment and determine how much you can afford to borrow.

Credit Unions

- Fewer Online Tools: While many credit unions are improving their online presence, they may not have as advanced technology as larger banks. Some credit unions may not offer fully online mortgage applications or convenient mobile apps for managing loans. However, they often make up for this with personalized service, so if you’re not as concerned about managing everything online, a credit union could still be a great option.

Which Option Is Right for You?

Deciding whether to get your mortgage through a bank or a credit union depends on several factors, including your financial situation, your preferences for customer service, and the importance of getting the best possible rates and fees. Here’s a quick guide to help you decide:

- Choose a Bank if:

- You need a variety of mortgage options, including jumbo loans or specific government-backed loans.

- You value efficiency and convenience, especially if you prefer a fully online process.

- You are comfortable with potentially higher fees in exchange for larger loan products and more streamlined service.

- Choose a Credit Union if:

- You want lower interest rates and fewer fees, especially if you meet their membership requirements.

- You value personalized service and prefer working with a local institution that takes a more hands-on approach.

- You are willing to accept a slightly slower process in exchange for better rates and customer service.

Conclusion

Both banks and credit unions offer significant advantages when it comes to getting a mortgage, but which one is right for you depends on your specific needs. If you prioritize low rates and fees and value personalized service, a credit union might be the best choice. On the other hand, if you need a variety of loan options, an efficient process, and online convenience, a bank could be the better option. Regardless of which route you choose, it’s important to shop around, compare rates, and evaluate all of your options before making a decision.