For many prospective homeowners, securing a mortgage can be a challenging task, especially when it comes to down payments, interest rates, and strict qualification requirements. Fortunately, there are specialized loan programs designed to make homeownership more accessible to individuals in specific circumstances. One of the most popular options is the USDA loan.

A USDA loan, backed by the U.S. Department of Agriculture (USDA), is a government-backed mortgage that aims to help low-to-moderate-income borrowers purchase homes in rural and suburban areas. With benefits such as no down payment and lower interest rates, USDA loans are an attractive option for eligible buyers who meet specific criteria. In this article, we’ll explore what USDA loans are, how they work, and who qualifies for this government-backed mortgage.

What Is a USDA Loan?

A USDA loan is a type of government-backed mortgage that is specifically designed to assist individuals and families in rural and suburban areas in purchasing a home. The loan is guaranteed by the USDA’s Rural Development (RD) program, which aims to promote homeownership, economic development, and the overall well-being of rural communities in the U.S.

Unlike conventional loans, which often require large down payments (sometimes 20% or more), USDA loans allow qualified borrowers to finance 100% of the purchase price of a home, meaning there is no down payment required. This makes the USDA loan program an attractive option for first-time homebuyers and those who may not have significant savings for a down payment.

Additionally, USDA loans typically offer lower interest rates and more flexible credit requirements than conventional loans, making them a viable option for buyers who may struggle to qualify for traditional mortgages.

How USDA Loans Work

The USDA guarantees these loans to reduce the lender’s risk, making it possible for lenders to offer favorable terms to borrowers. Since the government backs the loan, it helps reduce the cost of the mortgage for the borrower.

Here are some key features of USDA loans:

- No Down Payment: USDA loans require no down payment, which is one of the biggest advantages of this loan type. This allows borrowers to buy a home without needing to save for a large down payment, making it easier for individuals and families to enter the housing market.

- Lower Mortgage Insurance Costs: USDA loans require both an upfront and annual mortgage insurance premium (MIP). The upfront MIP is typically 1% of the loan amount and can be rolled into the loan itself. The annual MIP is lower than what’s required for FHA loans or conventional loans with low down payments, making the loan more affordable in the long run.

- Competitive Interest Rates: The interest rates on USDA loans are often lower than conventional mortgage rates, which can save borrowers a significant amount of money over the life of the loan.

- Long Loan Terms: USDA loans offer long-term repayment options, typically 30 years, which helps lower the monthly payment, making it more affordable for buyers.

- Flexible Credit Guidelines: While a minimum credit score of 640 is generally required for USDA loans, the program is more flexible than conventional loans, allowing borrowers with less-than-perfect credit to qualify.

Types of USDA Loans

There are two main types of USDA loans:

- Direct USDA Loans: These loans are provided directly by the USDA to eligible low-income borrowers. They typically come with lower interest rates, and in some cases, the USDA may offer a subsidy to reduce monthly payments for borrowers who meet very low-income requirements. However, direct loans are less common, as they are only available in limited situations, and the application process can be lengthy.

- Guaranteed USDA Loans: These are the most common type of USDA loans. They are provided by approved lenders (banks, credit unions, mortgage companies) and are backed by the USDA. The USDA guarantees a portion of the loan, reducing the lender’s risk, which allows for more favorable terms for borrowers. Most applicants seeking USDA loans will likely apply for a guaranteed loan rather than a direct loan.

Who Qualifies for a USDA Loan?

While USDA loans are designed to help low-to-moderate-income individuals and families, they are subject to specific eligibility requirements based on income, location, and other factors. Let’s break down the main qualification criteria:

1. Location of the Property

USDA loans are available for homes located in designated rural and suburban areas. The USDA defines rural areas as communities with populations of up to 35,000 people. These areas are typically outside major metropolitan areas but are still in close proximity to urban centers. It’s important to note that not all rural areas are eligible for USDA loans; only properties in specific rural zones qualify.

To determine whether a property is eligible, you can use the USDA’s online Property Eligibility Tool, which allows you to search by address and check whether the property is in an eligible rural area.

2. Income Limits

USDA loans are designed for low-to-moderate-income borrowers, and income limits vary based on the location and the size of the household. To qualify for a USDA loan, your income cannot exceed a specific limit based on your area’s median income. In general, USDA loans are available to households with incomes up to 115% of the area’s median income.

Income limits can vary significantly depending on the county or region, so it’s important to check the specific limits for the area where you are purchasing a home. Additionally, the USDA considers the total household income, including the incomes of all individuals living in the home (even if they are not on the loan).

3. Credit Score

While the USDA doesn’t have a specific credit score requirement, most lenders require a minimum credit score of 640 to qualify for a USDA loan. This helps streamline the application process and ensures that the borrower is likely to be able to repay the loan.

If your credit score is lower than 640, you may still qualify for a USDA loan, but you may have to go through additional documentation and underwriting to prove your ability to repay the loan.

4. Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is another important factor in determining your eligibility for a USDA loan. The USDA generally allows a DTI ratio of up to 41% (though in some cases, higher ratios may be considered if the borrower has a strong credit history or other compensating factors). The DTI ratio compares your total monthly debt payments to your gross monthly income and helps lenders assess your ability to manage additional debt.

5. Citizenship or Legal Residency

To qualify for a USDA loan, the borrower must be a U.S. citizen, U.S. non-citizen national, or a qualified legal resident of the United States.

6. Primary Residence

USDA loans are intended for borrowers purchasing a primary residence. You cannot use a USDA loan to purchase a vacation home, rental property, or investment property. The home must be occupied by the borrower as their primary residence.

7. Ability to Repay the Loan

Finally, like any other mortgage, you must have the ability to repay the loan. Lenders will evaluate your credit history, employment status, and financial situation to ensure that you can afford the monthly mortgage payments.

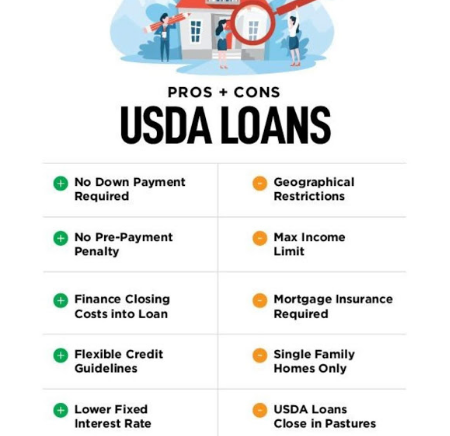

Advantages of USDA Loans

USDA loans offer numerous advantages, especially for first-time homebuyers and those with limited funds for a down payment. Some of the key benefits include:

- No Down Payment: USDA loans are one of the few loan programs that require no down payment, making them an excellent choice for first-time homebuyers who may struggle to save for a traditional down payment.

- Lower Interest Rates: USDA loans offer competitive interest rates, which can save borrowers money over the life of the loan.

- Flexible Credit Requirements: USDA loans are more forgiving than conventional loans, making them accessible to borrowers with less-than-perfect credit histories.

- Affordable Mortgage Insurance: Mortgage insurance premiums for USDA loans are generally lower than those for FHA or conventional loans with low down payments.

Disadvantages of USDA Loans

While USDA loans offer several benefits, there are a few potential drawbacks to consider:

- Location Restrictions: USDA loans are only available in eligible rural and suburban areas, so you may be limited in terms of where you can purchase a home.

- Income Limits: USDA loans are intended for low-to-moderate-income borrowers, which means high-income individuals or families may not qualify.

- Mortgage Insurance: While the mortgage insurance for USDA loans is lower than other loan programs, it is still an additional cost that borrowers must consider.

Conclusion

A USDA loan is an excellent option for qualified individuals looking to purchase a home in rural or suburban areas, especially for first-time homebuyers or those who may not have the savings for a large down payment. With no down payment requirement, lower interest rates, and more flexible credit guidelines, USDA loans can make homeownership more accessible. However, eligibility depends on factors like income, location, and credit history, so it’s essential to check whether you qualify before applying. If you meet the requirements, a USDA loan can be a great tool for achieving the dream of homeownership.