When it comes to securing a mortgage for a home, one of the most important factors to consider is the mortgage interest rate. The interest rate on your mortgage will directly affect your monthly payments, the total cost of your loan, and ultimately how affordable homeownership is for you. However, mortgage interest rates can be complex and influenced by a variety of factors. In this article, we will explore what mortgage interest rates are, how they are determined, and what you can do to secure the best rate for your loan.

1. What Are Mortgage Interest Rates?

Mortgage interest rates represent the cost of borrowing money to purchase a home. They are expressed as a percentage of the loan amount, which means they indicate how much you will need to pay in addition to the principal (the amount you borrowed) over the life of the loan.

For example, if you borrow $300,000 at a 4% annual interest rate, you will need to pay 4% of the loan amount every year as interest. Over the course of a 30-year mortgage, the interest adds up significantly, which is why securing a low-interest rate can save you thousands of dollars over time.

2. Fixed vs. Adjustable Mortgage Rates

There are two main types of mortgage interest rates: fixed rates and adjustable rates.

- Fixed-Rate Mortgages: With a fixed-rate mortgage, the interest rate remains the same for the entire term of the loan, whether that’s 15, 20, or 30 years. This means that your monthly payment (excluding taxes and insurance) will remain constant over time, providing stability and predictability. Fixed-rate mortgages are ideal for borrowers who want long-term consistency and plan to stay in the home for many years.

- Adjustable-Rate Mortgages (ARMs): With an ARM, the interest rate is initially set lower than a fixed-rate mortgage but will change periodically based on market conditions. The rate can increase or decrease over time, depending on the performance of an underlying index. This can make monthly payments fluctuate. ARMs are typically attractive to homebuyers who plan to sell or refinance before the interest rate increases significantly, but they carry more risk if rates rise sharply in the future.

3. How Are Mortgage Interest Rates Determined?

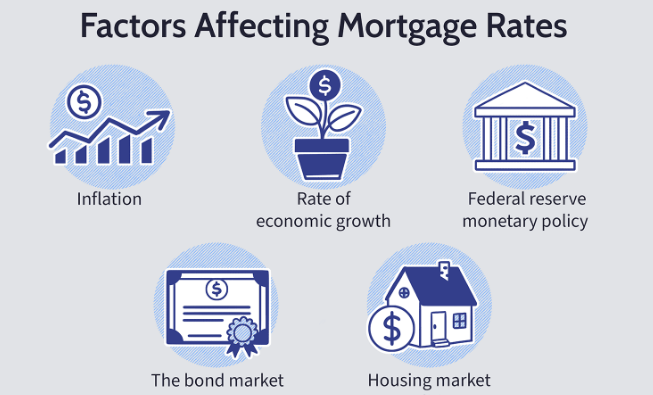

Mortgage interest rates are not determined in a vacuum. A variety of factors influence the rate that a lender offers you, including macro-economic indicators, individual financial factors, and market conditions. Below, we’ll explore the key elements that go into determining mortgage rates.

1. The Federal Reserve (Fed) and the Federal Funds Rate

One of the most significant influences on mortgage interest rates is the Federal Reserve, also known as the Fed. The Fed is the central bank of the United States, and its actions play a major role in shaping the overall economic environment, including interest rates.

The Federal Reserve sets the federal funds rate, which is the interest rate at which banks lend money to one another overnight. When the Fed raises or lowers the federal funds rate, it directly affects the interest rates that banks offer to consumers, including mortgage rates.

- When the Fed raises the federal funds rate, borrowing becomes more expensive for banks, which often results in higher mortgage interest rates for consumers.

- When the Fed lowers the federal funds rate, borrowing becomes cheaper for banks, which often leads to lower mortgage rates for consumers.

However, mortgage rates are not directly tied to the federal funds rate but are influenced by it. The mortgage market is more complex and influenced by a variety of other economic conditions.

2. Inflation

Inflation plays a crucial role in determining mortgage interest rates. Inflation refers to the rate at which the prices of goods and services rise over time, reducing the purchasing power of money. When inflation is high, lenders may raise interest rates to protect their investments from losing value due to inflation. Higher interest rates help compensate for the risk of lending money in an environment where inflation is eroding the value of the currency.

Conversely, when inflation is low, lenders may lower interest rates to encourage borrowing and stimulate economic growth. For homebuyers, this means that mortgage rates tend to be higher during times of high inflation and lower during times of low inflation.

3. Economic Growth

The state of the economy can also influence mortgage rates. When the economy is growing rapidly, demand for goods and services increases, which can lead to inflation. In response, the Federal Reserve may raise interest rates to cool down the economy and prevent inflation from spiraling out of control. Higher interest rates typically result in higher mortgage rates.

On the other hand, during periods of economic slowdown or recession, inflation tends to remain low, and the Federal Reserve may lower interest rates to stimulate borrowing and investment. This can result in lower mortgage rates, which is beneficial for borrowers.

4. The Housing Market

Mortgage rates can also be influenced by the conditions in the housing market. When demand for homes is high, competition among buyers increases, which can push up home prices. Higher home prices may prompt lenders to raise interest rates to maintain their profit margins.

Alternatively, in a slow housing market with fewer buyers, lenders may lower interest rates to attract borrowers and encourage more home purchases. This is particularly true if the housing market is struggling, as lenders may be motivated to make loans more affordable.

5. Your Personal Financial Situation

In addition to the broader economic factors, mortgage interest rates are also determined by your individual financial profile. Lenders will assess several key factors about your financial health before determining the interest rate they will offer you.

- Credit Score: Your credit score is one of the most important factors that lenders consider when setting your mortgage interest rate. A higher credit score indicates that you are a less risky borrower, which can qualify you for a lower interest rate. Conversely, a lower credit score means you are viewed as a higher-risk borrower, and you may be offered a higher interest rate.

- Down Payment: The size of your down payment also affects the interest rate. A larger down payment reduces the lender’s risk because it means you have more equity in the home. Borrowers who put down at least 20% may receive a lower interest rate because they are viewed as less risky. Those who put down less may face higher rates or be required to pay for Private Mortgage Insurance (PMI).

- Loan Type and Term: The type and length of your loan can impact your mortgage rate. For example, a 30-year fixed-rate mortgage generally has a higher interest rate than a 15-year fixed-rate mortgage because it represents a longer period of risk for the lender. Additionally, certain loan types, such as VA or FHA loans, may offer more favorable interest rates for eligible borrowers.

- Loan Amount: The size of the loan can also affect your mortgage rate. Larger loans may come with slightly higher interest rates due to the higher level of risk for the lender, while smaller loans may come with lower rates.

6. The Bond Market and Treasury Yields

Mortgage rates are also influenced by the bond market, specifically the 10-year U.S. Treasury bond yields. Lenders often base their mortgage rates on the returns they expect from long-term government bonds. When bond yields rise, mortgage rates tend to rise as well, and vice versa. The relationship between mortgage rates and Treasury yields is a key indicator for lenders in determining what rates to offer to homebuyers.

4. How to Secure the Best Mortgage Interest Rate

While some factors, such as inflation and the broader economy, are outside your control, there are several steps you can take to secure the best mortgage interest rate:

- Improve Your Credit Score: The higher your credit score, the better the interest rate you can qualify for. Work on improving your credit score by paying off debts, keeping credit card balances low, and correcting any errors on your credit report.

- Increase Your Down Payment: If possible, save for a larger down payment. A down payment of at least 20% can help you avoid private mortgage insurance (PMI) and may result in a lower interest rate.

- Shop Around: Don’t settle for the first mortgage rate you are offered. Compare offers from multiple lenders, including banks, credit unions, and online mortgage providers, to find the best deal.

- Consider the Loan Type and Term: A shorter loan term or a different loan type may offer a lower interest rate. If you can afford higher monthly payments, a 15-year mortgage may provide a better rate than a 30-year mortgage.

5. Conclusion

Mortgage interest rates are a critical component of the homebuying process, and understanding how they are determined can help you make more informed decisions when purchasing a home. Mortgage rates are influenced by a variety of factors, including economic conditions, the Federal Reserve’s policies, inflation, and your personal financial profile. By improving your credit, saving for a larger down payment, and shopping around for the best rates, you can secure a mortgage that meets your needs and saves you money over the long term.