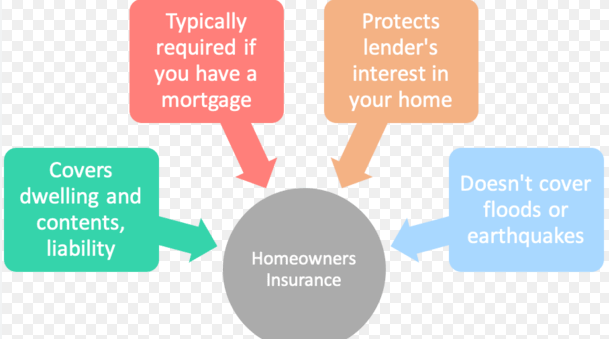

Why Do You Need Home Insurance If You Have a Mortgage?

Buying a home is one of the most significant financial investments you’ll make in your lifetime. Whether it’s your first home or a second property, securing a mortgage is usually necessary to help finance the purchase. However, as important as the loan is in helping you achieve homeownership, so is protecting that investment with home … Read more